In the second part of “How to Run a Successful Small Business” by Brian Silverthorn, you will be exploring the key aspects of navigating the financial landscape of a business. This includes acclimating new employees to the company culture, providing training and resources for employee success, emphasizing effective communication and time management, and ensuring employees have the right tools and technology for their jobs. The article also touches on the importance of personal growth and advancement opportunities, well-structured business practices, startup and operating capital, risk management, insurance and compliance requirements, committed leadership, continuous monitoring and evaluation, and building a positive reputation in the community. Additionally, the article mentions the Small Business Uprising two-day event at Cielo Estate in Northern California.

As you delve into this article, you’ll find valuable insights and practical advice on building and growing a successful small business that will help you whether you’re just starting out or looking to improve your current operations. Remember, success lies in being well-prepared, making informed decisions, and continually striving for improvement. So let’s embark on this journey together and discover the keys to navigating the financial landscape of your business.

Table of Contents

ToggleNavigating the Financial Landscape: Startup and Operating Capital

Starting and running a small business requires careful consideration of various financial aspects. One of the most crucial elements is securing startup and operating capital. In this article, we will explore the importance of startup and operating capital, discuss cash flow management and risk management strategies, and provide an overview of funding sources. Additionally, we will discuss the significance of creating a comprehensive financial plan, obtaining necessary insurance, permits, and compliance, and continuously evaluating and improving your financial strategies. Lastly, we will highlight the role of leadership in fostering financial responsibility. Let’s dive in!

Importance of Startup and Operating Capital

Understanding the Basics

Before delving into various financial strategies, it is important to understand the basics of startup and operating capital. Startup capital refers to the initial funds required to launch a business. This includes expenditures such as purchasing equipment, securing a location, hiring personnel, and marketing. On the other hand, operating capital is the ongoing funds needed to sustain day-to-day operations. This includes paying salaries, managing inventory, covering rent and utilities, and addressing any unexpected expenses.

Without sufficient startup and operating capital, a business may struggle to get off the ground or face financial hardships that can ultimately lead to failure. It is essential to carefully calculate and secure the necessary funds to ensure a smooth start and sustainable growth.

Determining Funding Needs

The amount of funding required for a business will vary depending on factors such as industry, business model, and growth projections. To determine funding needs, it is important to consider both one-time startup costs and ongoing operational expenses.

Start by conducting a thorough analysis of your business plan and financial projections. This will help you identify the specific funding needs for each phase of your business, from initial setup to ongoing operations. Consider factors such as fixed costs (rent, utilities, salaries) and variable costs (inventory, marketing, maintenance).

It is advisable to consult with a financial advisor or accountant to ensure accurate financial projections and a comprehensive understanding of your funding needs.

Exploring Funding Options

Once you have determined your funding needs, it is time to explore various funding options. Here are some popular choices for small businesses:

-

Self-Funding and Bootstrapping: Many entrepreneurs choose to use personal savings, credit cards, or loans from family and friends to finance their businesses. This option allows for maximum control and minimizes external dependencies.

-

Friends and Family: If you have a strong network of supportive individuals who believe in your business, consider approaching them for investment or loans. This option often comes with more flexible terms and a greater understanding of your business vision.

-

Angel Investors: Angel investors are individuals or groups who provide capital to startups in exchange for equity. They often bring expertise and industry connections along with their investment.

-

Venture Capitalists: Venture capitalists are institutional investors who provide funding to startups in exchange for equity. They typically invest in high-growth potential businesses and expect a substantial return on investment.

-

Crowdfunding: Platforms such as Kickstarter and Indiegogo allow businesses to raise funds from a large pool of individual investors. This option can help generate buzz and market validation while raising necessary funds.

-

Small Business Loans: Traditional banks and online lenders offer small business loans that can be used for startup or ongoing operational expenses. These loans often come with interest rates and repayment terms based on your creditworthiness and business viability.

-

Government Grants and Programs: Some governments offer grants, subsidies, or tax incentives to support small businesses. Research your local government offerings and see if you qualify for any programs.

It is essential to thoroughly research each funding option, considering factors such as interest rates, repayment terms, control requirements, and potential dilution of ownership. Additionally, seek advice from financial professionals or entrepreneurs who have previously secured funding to navigate the process successfully.

Cash Flow Management

Maintaining Positive Cash Flow

Cash flow management is arguably one of the most critical aspects of running a successful small business. It refers to the process of tracking and analyzing the flow of money into and out of your business. Maintaining positive cash flow is vital for covering expenses, managing debt, and reinvesting in your business’s growth.

To ensure positive cash flow, focus on the following strategies:

-

Accurate Cash Flow Forecasting: Regularly review your financial records and create cash flow forecasts. This will help you anticipate any cash shortages or surpluses and make informed decisions.

-

Timely Invoicing and Payments: Implement efficient invoicing procedures, ensuring that invoices are sent promptly and clearly communicate payment terms. Encourage timely payments by offering discounts for early payments or incorporating late payment penalties.

-

Controlling Expenses: Regularly review your expenses and identify opportunities for cost reduction. Negotiate with suppliers, streamline processes, and eliminate any unnecessary expenditures.

-

Negotiate Favorable Terms: When sourcing products or services, negotiate favorable payment terms with suppliers. This can include extended payment deadlines or discounts for early payments.

-

Inventory Management: Optimize your inventory management practices to avoid overstocking or shortages. Excess inventory ties up cash flow, while shortages can lead to missed sales opportunities.

-

Cash Reserves and Emergency Funds: Set aside a portion of your profits as cash reserves or emergency funds. This will provide a safety net during lean periods or unexpected expenses.

By implementing these strategies, you can ensure that your business maintains healthy cash flow, enabling it to operate efficiently and weather unforeseen financial challenges.

Budgeting and Forecasting

Budgeting and forecasting are essential tools for managing your business’s finances effectively. A budget is a financial plan that outlines your expected income and expenditures over a specific period. Forecasting, on the other hand, involves projecting future financial outcomes based on historical data, market trends, and business performance.

To create an effective budget and forecast, follow these steps:

-

Gather and Analyze Financial Data: Begin by collecting accurate financial data from previous periods. Analyze this data to identify patterns, trends, and areas for improvement.

-

Set Realistic Goals: Based on your analysis, set realistic financial goals for the upcoming period. Ensure that your goals align with your overall business objectives.

-

Estimate Revenues: Use historical data and market research to estimate your projected revenues. Consider factors such as sales volume, pricing, and potential risks or opportunities.

-

Assess Costs and Expenses: Take a detailed inventory of your fixed and variable costs. This can include operational expenses, salaries, marketing expenses, and debt repayments.

-

Create a Detailed Budget: Use the gathered data to create a comprehensive budget that outlines your projected income and expenses. Be sure to allocate funds for various categories and track your progress regularly.

-

Monitor and Adjust: Regularly monitor your actual performance against your budget and make necessary adjustments as needed. This will allow you to identify potential issues early and make informed financial decisions.

-

Forecast Future Growth: Utilize forecasting techniques to estimate your business’s future financial performance. Consider changes in market conditions, industry trends, and business strategies.

Budgeting and forecasting provide a roadmap for your business’s financial success. It helps you allocate resources effectively, make informed decisions, and adapt to changing market conditions.

Contingency Planning

Contingency planning involves proactively identifying and preparing for potential risks and setbacks that could impact your business’s financial stability. By developing a contingency plan, you can minimize the negative effects of unexpected events and ensure business continuity.

Here are some elements to consider when creating a contingency plan:

-

Risk Assessment: Identify potential risks to your business, such as economic downturns, natural disasters, supply chain disruptions, or changes in regulations. Assess each risk’s probability and potential impact on your business.

-

Develop Response Strategies: Once risks are identified, develop response strategies to mitigate their impact. This can include diversifying suppliers, maintaining adequate insurance coverage, establishing emergency funds, or implementing backup systems.

-

Crisis Communication Plan: In the event of a crisis, effective communication is crucial. Develop a communication plan that includes stakeholder notifications, media responses, and internal communication protocols.

-

Test and Refine: Regularly review and test your contingency plan to ensure its effectiveness. Update it as needed based on new risks or changes in your business’s operations.

Contingency planning demonstrates your commitment to protecting your business’s financial future. By being prepared for potential risks and having a well-thought-out response strategy, you can minimize disruptions and ensure your business’s long-term success.

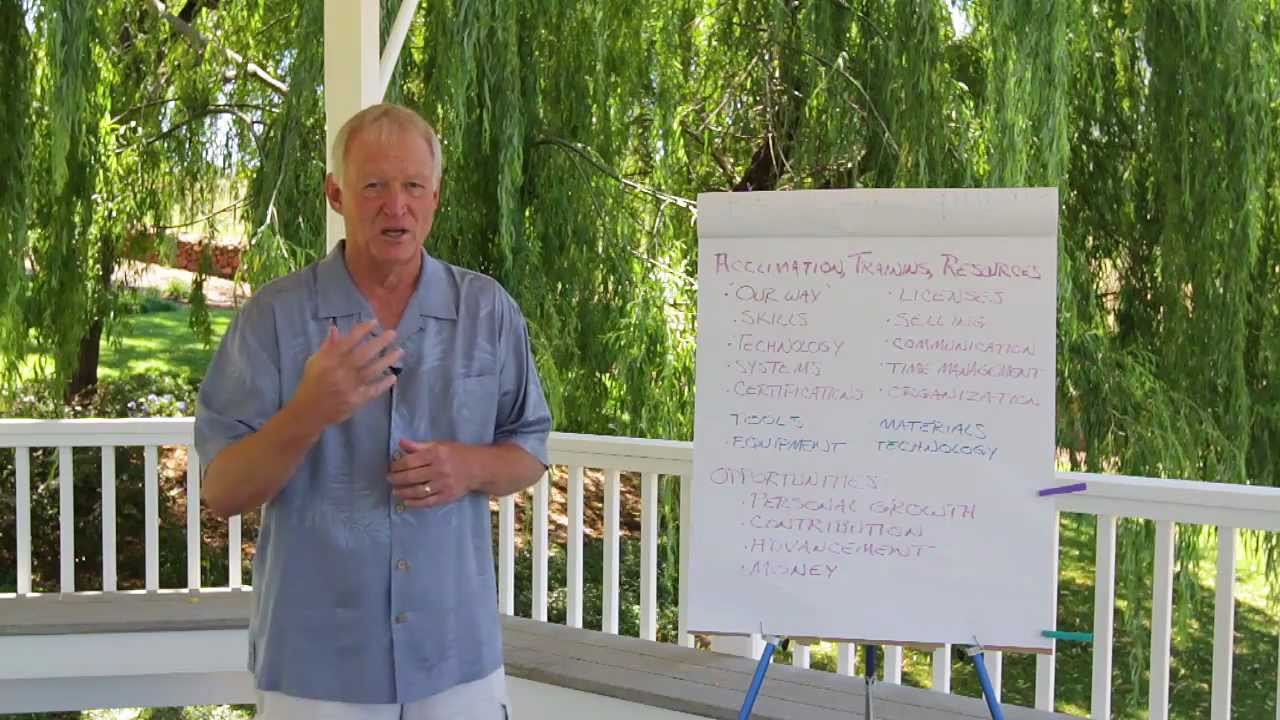

This image is property of i.ytimg.com.

Risk Management

Identifying and Mitigating Risks

Risk management involves identifying, assessing, and mitigating potential risks that could impact your business’s financial viability. By proactively managing risks, you can minimize their impact and protect your business from significant financial losses.

Here are some key steps to effective risk management:

-

Identify Risks: Conduct a comprehensive risk assessment for your business. Consider both internal and external factors that could pose risks, such as market fluctuations, operational vulnerabilities, cybersecurity threats, or regulatory changes.

-

Assess Probability and Impact: Once risks are identified, assess their probability of occurring and the potential impact on your business. This will help prioritize risks and allocate resources accordingly.

-

Develop Risk Mitigation Strategies: Develop strategies to mitigate identified risks and reduce their impact. This can include implementing security measures, diversifying suppliers, maintaining backups and redundancies, or acquiring appropriate insurance coverage.

-

Continuously Monitor and Update: Regularly review and monitor the effectiveness of your risk management strategies. Update your approach as necessary based on changes in your business or external factors.

By effectively managing risks, you can avoid potential financial pitfalls and maintain the stability and growth of your business.

Insurance Considerations

Insurance plays a crucial role in protecting your business from various risks and liabilities. By having the right insurance coverage, you can mitigate potential financial losses due to unforeseen events, accidents, or legal claims.

Here are some common types of business insurance to consider:

-

General Liability Insurance: Protects your business against claims of bodily injury, property damage, or product liability.

-

Property Insurance: Covers damage or loss of business property due to fire, theft, natural disasters, or vandalism.

-

Workers’ Compensation Insurance: Compensates employees for medical expenses and lost wages due to work-related injuries or illnesses.

-

Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, it covers professional services’ claims of negligence, mistakes, or inadequate work.

-

Cybersecurity Insurance: Protects against financial losses due to data breaches, privacy breaches, or cyber attacks.

-

Business Interruption Insurance: Helps cover lost income and additional expenses during periods of business disruption, such as natural disasters, equipment breakdowns, or utility failures.

Consult with an insurance broker or agent to assess your specific insurance needs based on your industry, business size, and potential risks. Carefully review policy terms, coverage limits, deductibles, and exclusions to ensure you have adequate protection.

Legal Compliance

Complying with legal and regulatory standards is essential for operating a successful small business. Failure to comply with legal requirements can result in financial penalties, lawsuits, reputational damage, or even the closure of your business.

Here are some important legal considerations to keep in mind:

-

Business Structure: Determine the appropriate legal structure for your business, such as sole proprietorship, partnership, LLC, or corporation. Consult with an attorney or tax advisor to understand the legal and tax implications of each option.

-

Permits and Licenses: Identify and obtain any necessary permits, licenses, or certifications required to operate your business legally. This may include health permits, zoning permits, professional licenses, or industry-specific certifications.

-

Employment Laws: Familiarize yourself with local, state, and federal employment laws and regulations. This includes laws related to minimum wage, overtime, employee benefits, discrimination, and workplace safety.

-

Tax Compliance: Understand your tax obligations and ensure accurate record-keeping and timely payment of taxes. Consult with a tax professional to navigate complex tax laws and take advantage of available deductions and credits.

-

Intellectual Property Protection: Safeguard your business’s intellectual property assets, such as trademarks, copyrights, or patents. Consult with an intellectual property attorney to ensure appropriate registration and protection.

-

Privacy and Data Protection: Understand and comply with data protection laws and regulations to safeguard sensitive customer information. This includes obtaining consent for data collection, ensuring secure data storage, and implementing appropriate cybersecurity measures.

Seek professional advice from attorneys, accountants, or industry-specific consultants to ensure compliance with all applicable legal requirements. Regularly review and update your policies and procedures to reflect any changes in laws or regulations.

Funding Sources for Startups

Securing funding for your startup is an essential step towards turning your business idea into a reality. Let’s explore some common funding sources for startups:

Self-Funding and Bootstrapping

Self-funding involves using personal savings or assets to finance your business. Bootstrapping, on the other hand, refers to starting a business with minimal external funding and relying on revenue generated by the business to fuel growth.

Self-funding and bootstrapping offer several advantages, including maximum control over your business, flexibility in decision-making, and minimized dependency on external investors. However, it may limit your ability to invest in rapid expansion or capital-intensive ventures.

Friends and Family

Friends and family can be a valuable source of funding for startups. These individuals already have a personal connection with you and may be willing to invest in your business. However, it is crucial to treat these investments professionally and formalize agreements to avoid any potential conflicts or misunderstandings.

When approaching friends and family, clearly communicate the risks involved, repayment terms, and expectations. Consider seeking legal advice and formalizing investments through written agreements to protect both parties’ interests.

Angel Investors

Angel investors are high-net-worth individuals who provide financial support to startups in exchange for an equity stake in the company. In addition to financial capital, angel investors often bring industry expertise, connections, and mentorship to the table.

To attract angel investors, ensure your business has a compelling business plan, a clear growth strategy, and a strong value proposition. Research local angel investor networks or use online platforms dedicated to connecting startups with potential investors.

Venture Capitalists

Venture capitalists (VCs) are institutional investors who provide funding to startups in exchange for an equity stake. VC firms typically invest in high-growth potential businesses that have the potential to deliver significant returns on investment.

When seeking venture capital funding, be prepared to demonstrate scalability, market potential, and a solid business plan. VCs often look for startups with the potential to disrupt industries or create innovative solutions.

Crowdfunding

Crowdfunding platforms, such as Kickstarter and Indiegogo, enable entrepreneurs to raise funds from a large pool of individuals. Supporters can contribute varying amounts of money in exchange for early access to products, rewards, or equity.

To run a successful crowdfunding campaign, create a compelling pitch, articulate the unique value proposition of your product or service, and leverage social media and other marketing channels to reach your target audience.

Small Business Loans

Traditional banks, as well as online lenders, offer small business loans to entrepreneurs who meet certain criteria. Small business loans can provide the necessary capital for startup costs, equipment purchases, or working capital.

Before applying for a loan, ensure your business plan, financial projections, and credit history are in order. Research different lenders and compare interest rates, repayment terms, and eligibility requirements to find the best fit for your business.

Government Grants and Programs

Many governments offer grants, subsidies, or tax incentives to support small businesses. Research your local government offerings, industry-specific grants, or programs designed to foster entrepreneurial growth.

Government grants and programs often come with specific eligibility criteria and application processes. Prepare a compelling grant proposal that clearly demonstrates how your business aligns with the government’s goals and objectives.

When seeking funding for your startup, carefully consider the terms and conditions of each option, as well as the potential implications on your ownership and decision-making. Consult with financial and legal professionals to ensure you make informed decisions and protect your interests.

This image is property of images.unsplash.com.

Creating a Comprehensive Financial Plan

A comprehensive financial plan is essential for running a successful small business. It serves as a roadmap for achieving your business’s financial goals and provides a framework for monitoring and evaluating your financial performance. Let’s discuss key components of a robust financial plan:

Setting Financial Goals

Start by defining your short-term and long-term financial goals. These goals should be specific, measurable, attainable, relevant, and time-bound (SMART). Examples of financial goals may include increasing revenue by a certain percentage, reducing expenses, or achieving a specific profit margin.

When setting financial goals, consider both quantitative and qualitative factors. Quantitative goals focus on financial metrics, such as revenue, profitability, or return on investment. Qualitative goals emphasize non-financial aspects, such as customer satisfaction, employee retention, or market share.

Developing a Budget

A well-defined budget is a critical component of your financial plan. It provides a detailed breakdown of your expected income and expenses, enabling you to allocate resources effectively and monitor your financial performance.

When developing a budget, consider the following steps:

-

Identify Revenue Sources: Determine your primary revenue streams and estimate their potential income. This can include product sales, service fees, or subscription revenues.

-

Categorize Expenses: Categorize your expenses into fixed costs (rent, salaries) and variable costs (marketing, inventory). Create a detailed list of all anticipated expenses, ensuring each item is accounted for.

-

Allocate Resources: Allocate resources to each expense category based on their priority and potential return on investment. Consider adjusting allocations based on changing business needs or market conditions.

-

Incorporate Sensitivity Analysis: Perform sensitivity analysis to understand the potential impact of changes in revenue or expenses. This will help you identify areas of vulnerability and develop contingency plans.

-

Continuously Track and Review: Regularly monitor and review your actual financial performance against your budget. Compare variances, identify areas for improvement, and make necessary adjustments.

A well-executed budget allows you to make informed financial decisions, identify potential shortfalls or excesses, and proactively address any deviations from your financial goals.

Tracking and Analyzing Financial Performance

Tracking and analyzing your financial performance is crucial for understanding your business’s profitability, liquidity, and overall financial health. It enables you to make data-driven decisions, identify areas for improvement, and make adjustments to your business strategies.

Consider the following practices for effective financial performance tracking:

-

Accurate Bookkeeping: Maintain accurate and up-to-date financial records. This includes recording all transactions, reconciling accounts, and organizing supporting documentation.

-

Key Performance Indicators (KPIs): Identify and track key financial metrics that align with your business objectives. Examples of financial KPIs may include gross profit margin, net profit margin, break-even point, or accounts receivable turnover.

-

Financial Statements: Regularly prepare and analyze financial statements, including income statements, balance sheets, and cash flow statements. These statements provide a snapshot of your business’s financial position and performance.

-

Ratios and Benchmarks: Calculate and compare financial ratios and benchmarks to assess your business’s financial health and performance. Examples may include liquidity ratios, profitability ratios, or industry-specific benchmarks.

-

Financial Analysis Tools: Utilize financial analysis tools or software to automate data collection, calculations, and reporting. This can streamline the process and provide more accurate and timely insights.

By regularly tracking and analyzing your financial performance, you can identify trends, spot potential issues, and make informed decisions to improve your business’s financial outcomes.

Seeking Professional Financial Advice

Seeking professional financial advice is highly beneficial, especially for small business owners who may not have extensive financial expertise. Financial advisors, accountants, or consultants can provide valuable insights, guidance, and support on various financial matters.

When searching for a financial professional, consider the following factors:

-

Qualifications and Experience: Look for professionals with relevant qualifications, certifications, and industry experience. Consider their track record and reputation within the industry.

-

Compatibility and Communication: Choose a financial professional who understands your business, industry, and goals. Ensure effective communication and a good working relationship.

-

Specialized Expertise: Depending on your business’s unique financial needs, look for professionals with specialized expertise. This may include tax planning, business valuation, or investment strategies.

-

Cost and Value: Consider the cost of financial services and the value they can provide to your business. Assess the potential return on investment and weigh it against the fees or commissions charged.

Remember, seeking professional financial advice is an investment in the long-term success and growth of your business. A competent financial professional can help you navigate complex financial decisions, optimize your resources, and achieve your financial goals.

Insurance, Permits, and Compliance

Understanding Insurance Requirements

Insurance plays a critical role in protecting your business, employees, and assets from unexpected events and potential liabilities. Understanding your insurance requirements and obtaining appropriate coverage is essential for mitigating financial risks. Here are some common types of business insurance to consider:

-

General Liability Insurance: General liability insurance protects your business against claims of bodily injury, property damage, or advertising injury. It covers legal fees, settlements, and judgments in the event of a lawsuit.

-

Property Insurance: Property insurance provides coverage for damage or loss of business property due to events such as fire, theft, vandalism, or natural disasters. It includes buildings, equipment, inventory, and furniture.

-

Workers’ Compensation Insurance: Workers’ compensation insurance compensates employees for medical expenses, lost wages, and rehabilitation services in the event of a work-related injury or illness. It also protects the business from potential lawsuits related to workplace injuries.

-

Professional Liability Insurance: Professional liability insurance, also known as errors and omissions (E&O) insurance, protects professionals and businesses that provide professional services against claims of negligence, mistakes, or inadequate work. It covers legal defense costs and settlements.

-

Cybersecurity Insurance: Cybersecurity insurance protects your business from financial losses due to data breaches, privacy breaches, or cyber attacks. It covers legal fees, costs of customer notification, credit monitoring services, and potential losses associated with the breach.

These are just a few examples of the many insurance options available. Consult with an insurance broker or agent to assess your specific business insurance needs. They can help you evaluate potential risks, recommend appropriate coverage, and assist in purchasing policies from reputable insurance providers.

Obtaining Permits and Licenses

Obtaining the necessary permits and licenses is an essential part of operating a legal and compliant business. Failure to obtain the required permits and licenses can result in fines, penalties, or even legal closure. Here are some common permits and licenses:

-

Business License: Most municipalities require businesses to obtain a business license, also known as a tax registration certificate or business tax certificate. This license allows you to legally operate your business within a specific jurisdiction.

-

Zoning Permits: Zoning permits ensure that your business location is appropriate for the activities you intend to conduct. These permits regulate the use of land and ensure compliance with local zoning laws.

-

Professional Licenses: Certain professions, such as doctors, lawyers, accountants, or real estate agents, require specialized professional licenses. These licenses ensure that individuals possess the necessary qualifications and meet industry-specific standards.

-

Health and Safety Permits: Depending on the nature of your business, you may need health and safety permits. These permits are required for businesses that handle food, hazardous materials, or operate in industries with specific regulations, such as healthcare or childcare.

Research the specific permits and licenses needed for your industry and location. Contact your local government authorities or consult with an attorney to ensure you meet all legal requirements.

Complying with Regulatory Standards

Compliance with regulatory standards is essential for operating a legal and ethical business. Non-compliance can result in legal ramifications, fines, or reputational damage. Here are some areas to consider for regulatory compliance:

-

Employment Laws: Familiarize yourself with applicable local, state, and federal employment laws. Understand regulations related to minimum wage, overtime, worker’s rights, anti-discrimination, and workplace health and safety.

-

Privacy and Data Protection: Ensure compliance with relevant data protection laws, such as the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA). Review your data handling practices, obtain proper consent for data collection, and implement appropriate security measures.

-

Financial Reporting and Tax Compliance: Comply with financial reporting regulations and tax requirements imposed by local authorities. Maintain accurate financial records, submit required reports, and meet tax filing deadlines.

-

Environmental Regulations: If your business engages in activities that may impact the environment, familiarize yourself with applicable environmental regulations. Ensure proper waste disposal, pollution prevention, and adherence to conservation practices.

Consult with legal professionals who specialize in regulatory compliance to ensure your business operates within the bounds of the law. Regularly update your policies and procedures to reflect changes in regulations and industry standards.

This image is property of images.unsplash.com.

Continuously Evaluating and Improving

Monitoring Key Financial Metrics

Monitoring key financial metrics on an ongoing basis is essential for assessing your business’s financial performance and identifying areas for improvement. Key financial metrics provide insights into profitability, liquidity, efficiency, and overall financial health. Here are some key financial metrics to consider:

-

Gross Profit Margin: Gross profit margin measures the percentage of revenue left after subtracting the direct costs associated with producing goods or services. A higher gross profit margin indicates greater profitability.

-

Net Profit Margin: Net profit margin measures the percentage of revenue left after subtracting all costs, including indirect costs such as overhead and taxes. It provides a clear picture of overall profitability.

-

Cash Flow: Regularly track and analyze your cash flow, including inflows and outflows of cash. Positive cash flow indicates that your business can meet its financial obligations and invest in growth.

-

Return on Investment (ROI): ROI measures the return generated from an investment relative to its cost. It helps assess the profitability of specific investments or initiatives.

-

Accounts Receivable Turnover: Accounts receivable turnover measures how quickly your business collects payments from customers. It reflects your ability to convert sales into cash.

-

Inventory Turnover: Inventory turnover measures how efficiently your business manages its inventory. It shows how quickly inventory is sold and replaced.

-

Debt-to-Equity Ratio: The debt-to-equity ratio compares the amount of debt to the amount of equity in your business. It assesses your business’s financial leverage and risk.

By monitoring and analyzing these key financial metrics regularly, you can identify trends, make informed decisions, and address areas for improvement proactively.

Identifying Areas for Improvement

Identifying areas for improvement is essential for continuously growing and optimizing your business. Regularly analyze your business operations, financial performance, and customer feedback to uncover opportunities for enhancement. Here are some areas to focus on:

-

Operational Efficiency: Streamline your business processes to eliminate waste, reduce costs, and enhance productivity. Identify bottlenecks, automate repetitive tasks, and improve overall workflow.

-

Customer Experience: Continually assess and improve your customers’ experience. Solicit feedback, analyze customer satisfaction metrics, and implement improvements based on customer insights.

-

Marketing and Sales Strategies: Evaluate your marketing and sales efforts to ensure they align with changing market trends and customer preferences. Explore new marketing channels, refine your messaging, and optimize your sales funnels.

-

Cost Management: Review your expenses and seek opportunities to reduce costs and improve cost efficiency. Negotiate with suppliers, analyze spending patterns, and implement cost-saving initiatives.

-

Innovation and Technology Adoption: Stay abreast of industry trends and adopt innovative technologies that can enhance your business’s efficiency, customer reach, or competitive advantage.

-

Employee Development and Engagement: Invest in your employees’ development and create an engaging work environment that fosters productivity, collaboration, and creativity. Regularly assess employee satisfaction and provide opportunities for growth and advancement.

Continuous improvement requires a commitment to ongoing evaluation, feedback collection, and a willingness to adapt and change. Embrace a culture of continuous improvement to stay ahead of your competition and meet the evolving needs of your customers.

Implementing Changes

Identifying areas for improvement is just the first step. Effective implementation of changes is crucial for real progress and impactful results. Here’s how to successfully implement changes:

-

Clearly Define Goals: Clearly communicate the goals and objectives of the changes to your team. Ensure everyone understands why the changes are necessary and how they align with the overall business strategy.

-

Create an Action Plan: Develop a well-defined action plan that outlines the specific steps and timeline for implementing the changes. Assign responsibilities and establish accountability.

-

Communicate and Involve Your Team: Effective communication is essential for successful change implementation. Involve your team in the process, listen to their feedback and concerns, and address any resistance or challenges.

-

Monitor Progress and Make Adjustments: Regularly monitor the progress of change implementation and identify any roadblocks or hurdles. Make necessary adjustments, seek feedback from your team, and make course corrections as needed.

-

Provide Training and Support: If the changes require new skills or processes, provide adequate training and support to your team. Ensure that they have the necessary tools, resources, and knowledge to successfully adapt to the changes.

Successful change implementation requires a combination of effective leadership, clear communication, and supportive team dynamics. Embrace a collaborative approach and navigate any challenges or resistance with open-mindedness and empathy.

Seeking Feedback and Adaptation

Feedback plays a crucial role in improving your business’s performance and identifying areas for growth. Actively seek feedback from customers, employees, and other stakeholders to gain valuable insights and make informed decisions. Here’s how to effectively seek and utilize feedback:

-

Customer Feedback: Regularly collect feedback from your customers to understand their needs, preferences, and pain points. Utilize surveys, focus groups, or online reviews to gather feedback and implement improvements based on customer insights.

-

Employee Feedback: Create a culture of open communication and provide avenues for employees to share feedback, suggestions, and concerns. Encourage regular one-on-one meetings, team discussions, or anonymous suggestion boxes.

-

Performance Reviews: Conduct regular performance reviews for your team members to provide feedback on their performance and identify areas for improvement. Use these reviews as an opportunity for two-way communication and goal-setting.

-

Industry Trends and Benchmarks: Stay updated on industry trends, benchmark your performance against competitors, and learn from best practices. Attend industry conferences, join professional associations, and network with peers to gain insights and identify improvement opportunities.

Incorporate feedback into your decision-making processes and adapt your strategies accordingly. Listen actively, be receptive to constructive criticism, and continually strive to enhance your business’s performance based on the feedback received.

The Role of Leadership

Fostering a Culture of Financial Responsibility

Leadership plays a crucial role in fostering a culture of financial responsibility within your business. As a leader, your actions and decisions set the tone for financial management practices and influence your team’s behavior. Here’s how to cultivate a culture of financial responsibility:

-

Set Clear Expectations: Clearly communicate financial expectations to your team. Outline the importance of financial responsibility, resource management, and the impact of individual actions on the financial health of the business.

-

Lead by Example: Demonstrate responsible financial practices through your own actions and decisions. Be transparent with financial information, adhere to budgets and financial plans, and make sound financial decisions.

-

Provide Financial Training: Invest in financial literacy training for your team members. Ensure they understand basic financial concepts, budgeting, and the importance of financial goals.

-

Foster Collaboration: Encourage collaboration and cross-functional communication when it comes to financial decision-making. Involve relevant team members in financial discussions and empower them to contribute their expertise.

-

Recognize and Reward Financial Responsibility: Acknowledge and reward individuals or teams who demonstrate financial responsibility, innovative cost-saving measures, or successful budget management. Celebrate financial milestones and encourage a sense of ownership over financial outcomes.

By fostering a culture of financial responsibility, you empower your team to make informed financial decisions, contribute to cost-saving initiatives, and take ownership of the business’s financial success.

Making Strategic Financial Decisions

As a leader, making strategic financial decisions is one of your key responsibilities. Strategic financial decisions directly impact your business’s growth, profitability, and long-term success. Here are some considerations for making effective strategic financial decisions:

-

Gather and Analyze Data: Collect accurate and reliable financial data to inform your decision-making process. Analyze market trends, financial statements, performance metrics, and industry benchmarks to gain insights.

-

Evaluate Risks and Rewards: Assess the risks associated with each financial decision and weigh them against the potential rewards. Consider factors such as market conditions, competition, industry trends, and your business’s financial capabilities.

-

ROI Analysis: Conduct a return on investment (ROI) analysis for each financial decision. Evaluate the potential financial impact, payback periods, and break-even points to assess the feasibility of the decision.

-

Align with Business Goals: Ensure your financial decisions align with your overall business goals and objectives. Evaluate how each decision contributes to revenue growth, cost reduction, competitive advantage, or customer satisfaction.

-

Seek Input and Expertise: Consult with financial professionals, advisors, or industry experts to gather diverse perspectives and insights. Consider the potential implications of each decision from multiple angles.

Making strategic financial decisions requires a combination of analytical skills, industry knowledge, and visionary thinking. Embrace a data-driven and forward-looking approach to position your business for long-term success.

Building a Strong Financial Team

Building a strong financial team is essential for effective financial management within your business. Your financial team plays a crucial role in maintaining accurate records, analyzing financial data, and providing valuable insights. Here’s how to build a strong financial team:

-

Hire Qualified Professionals: Hire skilled professionals with the necessary qualifications and experience in finance, accounting, or financial analysis. Look for individuals who demonstrate strong analytical skills, attention to detail, and a solid understanding of financial principles.

-

Foster Collaboration: Encourage collaboration and open communication within your financial team and with other departments. Emphasize the importance of cross-functional collaboration and integration of financial insights into decision-making processes.

-

Invest in Training and Development: Provide opportunities for ongoing training and professional development for your financial team members. Encourage them to stay updated with industry trends, technological advancements, and evolving financial regulations.

-

Establish Clear Roles and Responsibilities: Clearly define the roles and responsibilities of each team member to avoid duplication of efforts or miscommunication. Establish clear reporting lines and accountability systems within the team.

-

Provide Adequate Resources: Ensure your financial team has access to the necessary tools, software, and resources to perform their duties effectively. Invest in accounting software, financial analysis tools, and other resources that streamline financial processes.

-

Recognize and Reward Performance: Acknowledge and reward exceptional performance within your financial team. Provide incentives for achieving financial goals, cost savings, or other financial achievements.

Building a strong financial team requires finding the right talent, establishing effective communication channels, and providing a supportive work environment. Empower your financial team to serve as trusted advisors who contribute to your business’s financial success.

This image is property of images.unsplash.com.

Conclusion

Navigating the financial landscape of a small business requires careful consideration of various factors. By understanding the importance of startup and operating capital, implementing effective cash flow and risk management strategies, and exploring funding sources, you can set your business on a path towards financial success.

Creating a comprehensive financial plan, obtaining necessary insurance and permits, continuously evaluating and improving your financial strategies, and fostering a culture of financial responsibility contribute to sustained growth and profitability.

Strong leadership, strategic financial decision-making, and a capable financial team are critical ingredients for a successful small business.

Remember, financial management is an ongoing process that requires adaptability, continuous learning, and a commitment to excellence. By prioritizing financial management practices and leveraging the resources available to you, you can confidently navigate the financial landscape, protect your business, and achieve long-term success.